straight life policy term

CFlexible Premium Variable Life. The face value of.

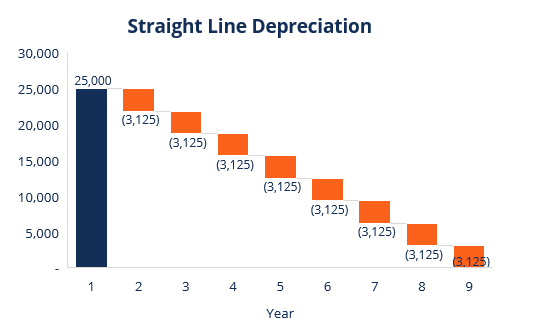

Depreciation Methods 4 Types Of Depreciation You Must Know

Term life insurance policy providing a fixed-amount death benefit over a certain number of years.

. Like other forms of whole life insurance the death benefit of a straight life policy is. Life Paid-up at Age 65. Get A Personalized Quote In Seconds.

10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100. Straight Life Policy an ordinary life policy or whole life policy. Straight Term Insurance Policy.

What is a Straight Life Policy. BWhole Life policy with two premiums. Straight life insurance can be used as a financial planning tool.

Compare Find the Best Policy For You Save. Ad Compare the Best Life Insurance Providers. In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term.

Straight term insurance policy. If you have a short-term life insurance need term life. Term life insurance policies are only good for a specific set of years usually 15 20 or 30 depending on the policy.

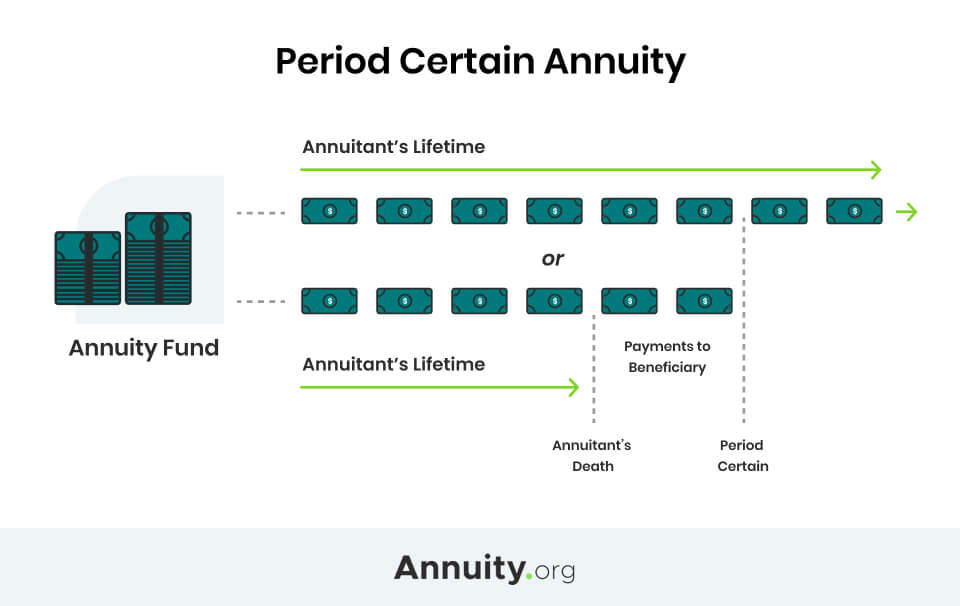

The goal of a permanent policy is to have life insurance in place for the rest of your life. Ad Rates starting at 11 a month. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

What Does Whole Life Insurance Mean. Term periods may last anywhere from a year to 30 years. This traditional life insurance is sometimes also known as.

A life insurance policy that provides coverage only for a certain period of time. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings. This type of policy can be used as an estate planning tool or to provide financial security.

Comparing Different Term Plans. Term life insurance policies have two different. What is Straight life.

Importantly term life insurance policies do not possess monetary unless the holder dies within the term. 2022 Reviews Trusted by 45000000. It is also known as ordinary life insurance or.

A Limited-Pay Life policy has A. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Term life policies will also halt coverage if you stop making your premium payments. See your rate and apply now. Help protect your loved ones with valuable term coverage up to 100000.

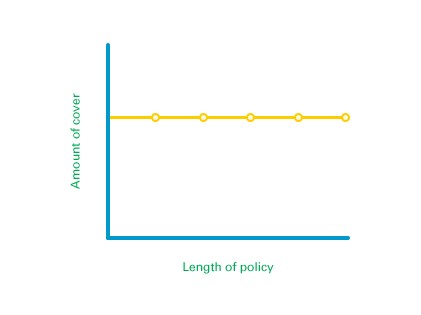

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Renewable Term to Age 70.

Straight Whole Life Insuranceor ordinary life. Ad Locked In Rate Flexible Payment Schedule And More. Insurance on the life of the.

February 27 2022. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Straight life insurance is a type of whole life insurance.

Term Ticket Model. A straight term insurance policy provides a benefit upon the death of the. Straight life insurance is a type of permanent life insurance.

Which of the following is an example of limited pay life policy A Level Term Life B. Life Paid-up at Age 65 D. Straight life insurance is.

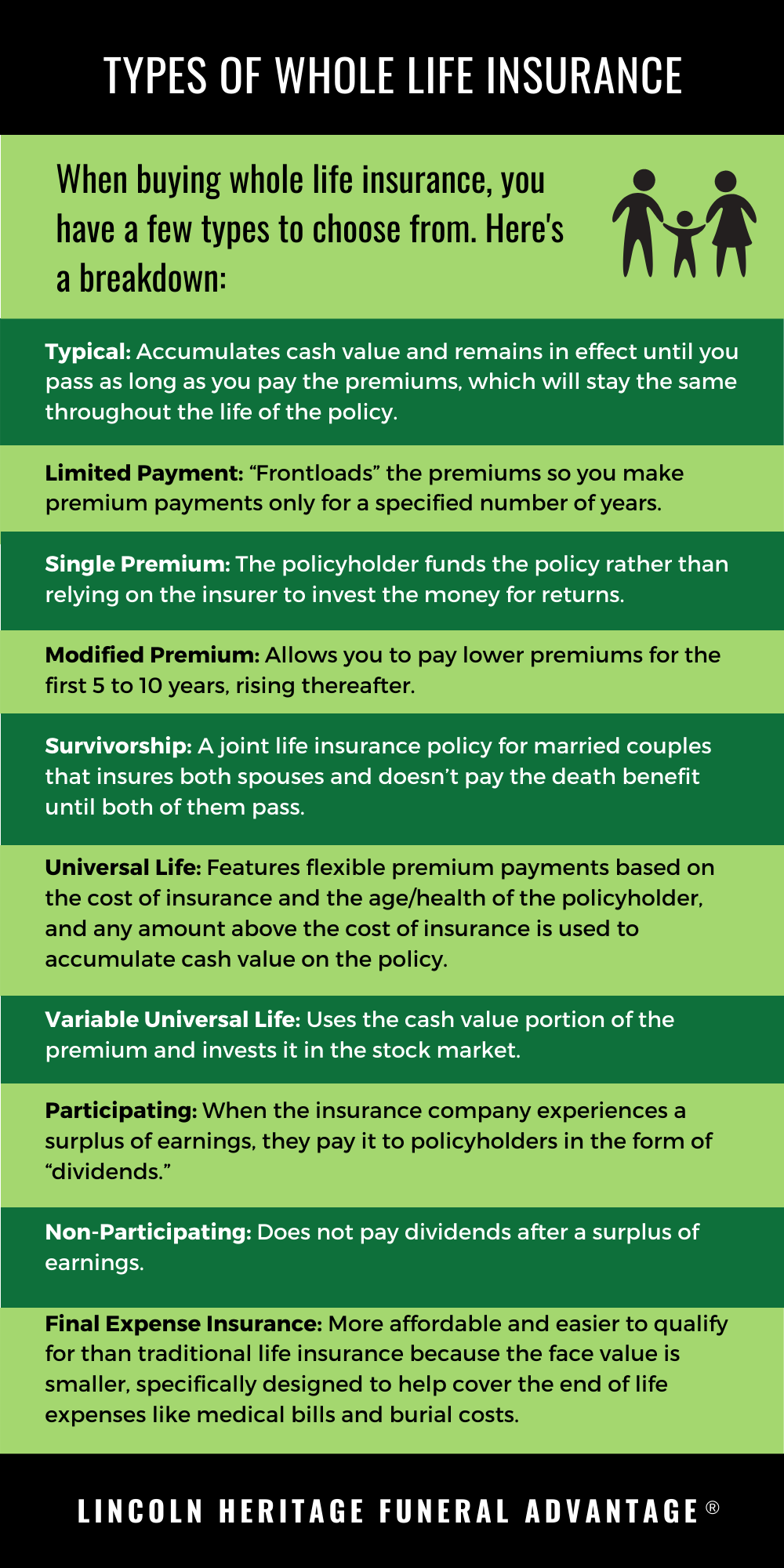

The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart. A Universal Life Insurance policy is best described as. Whole life insurance or whole of life assurance in the Commonwealth of Nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in.

Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy. It is meant for long-term goals and not short-term needs. Life Paid-Up at Age 70.

AVariable Life with a cash value account. A whole life policy in which premiums are payable as long as the insured lives. STRAIGHT LIFE INSURANCE noun The noun STRAIGHT LIFE INSURANCE has 1 sense.

Traditional whole life insurance is good for the lifetime of. Ad Our Comparison Chart Makes Choosing Simple. A father who dies within 3 years after purchasing a.

What does straight life insurance mean.

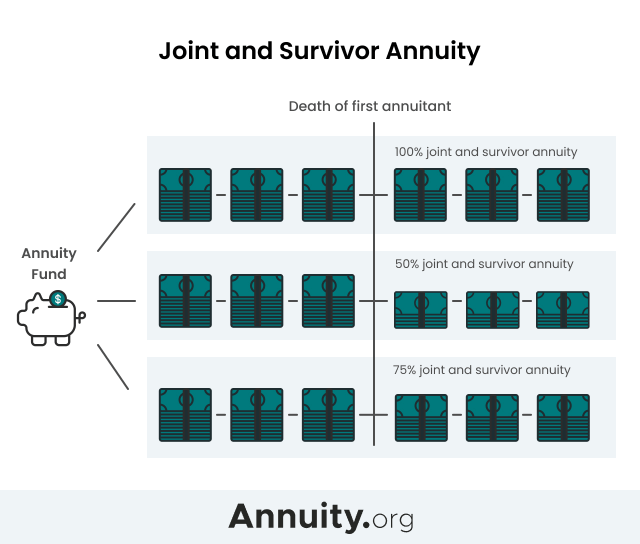

Joint And Survivor Annuity The Benefits And Disadvantages

Whole Life Insurance Definition

Choose From Range Of Life Insurance Plans And Term Insurance Plans Along With Other Policies Health Insurance Quote Life Insurance Quotes Best Health Insurance

Straight Line Depreciation Formula Guide To Calculate Depreciation

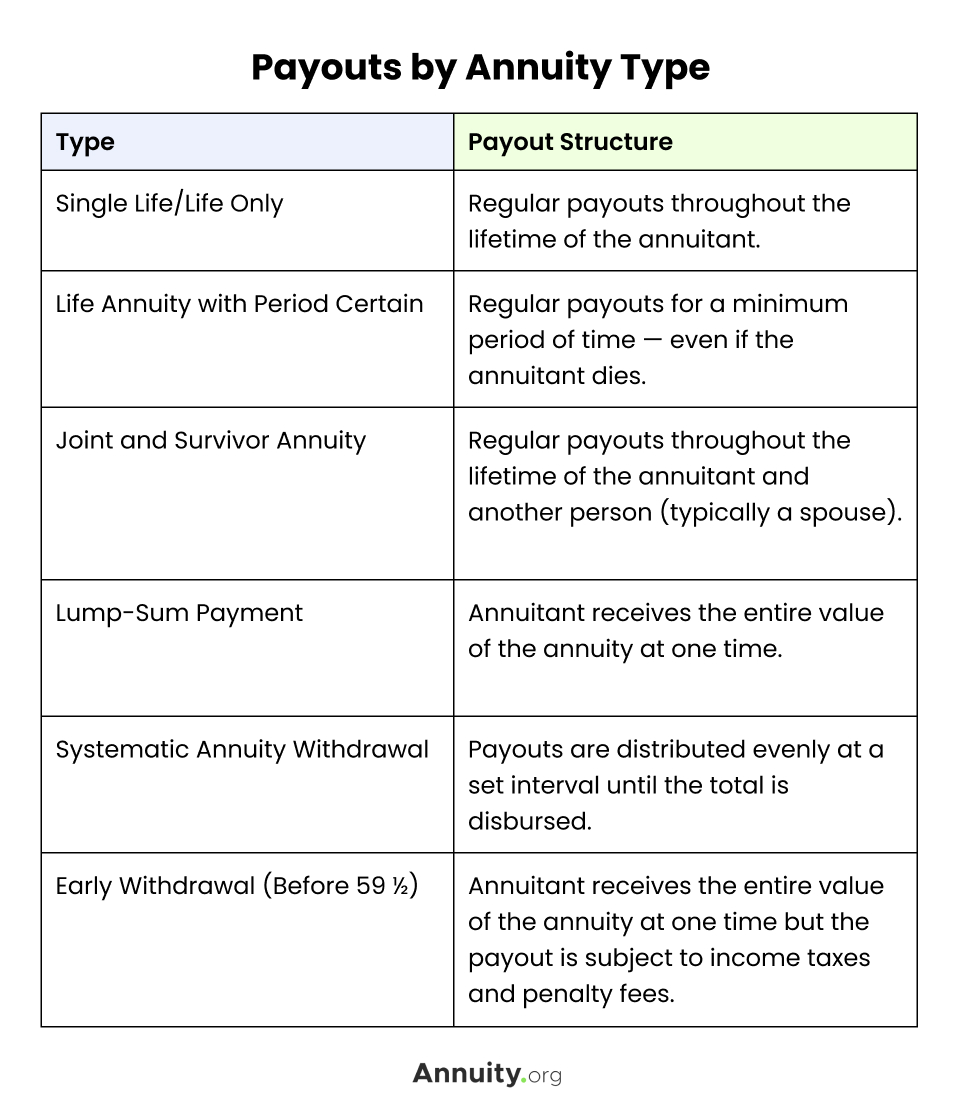

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Line Depreciation Formula Guide To Calculate Depreciation

What Is Whole Life Insurance Cost Types Faqs

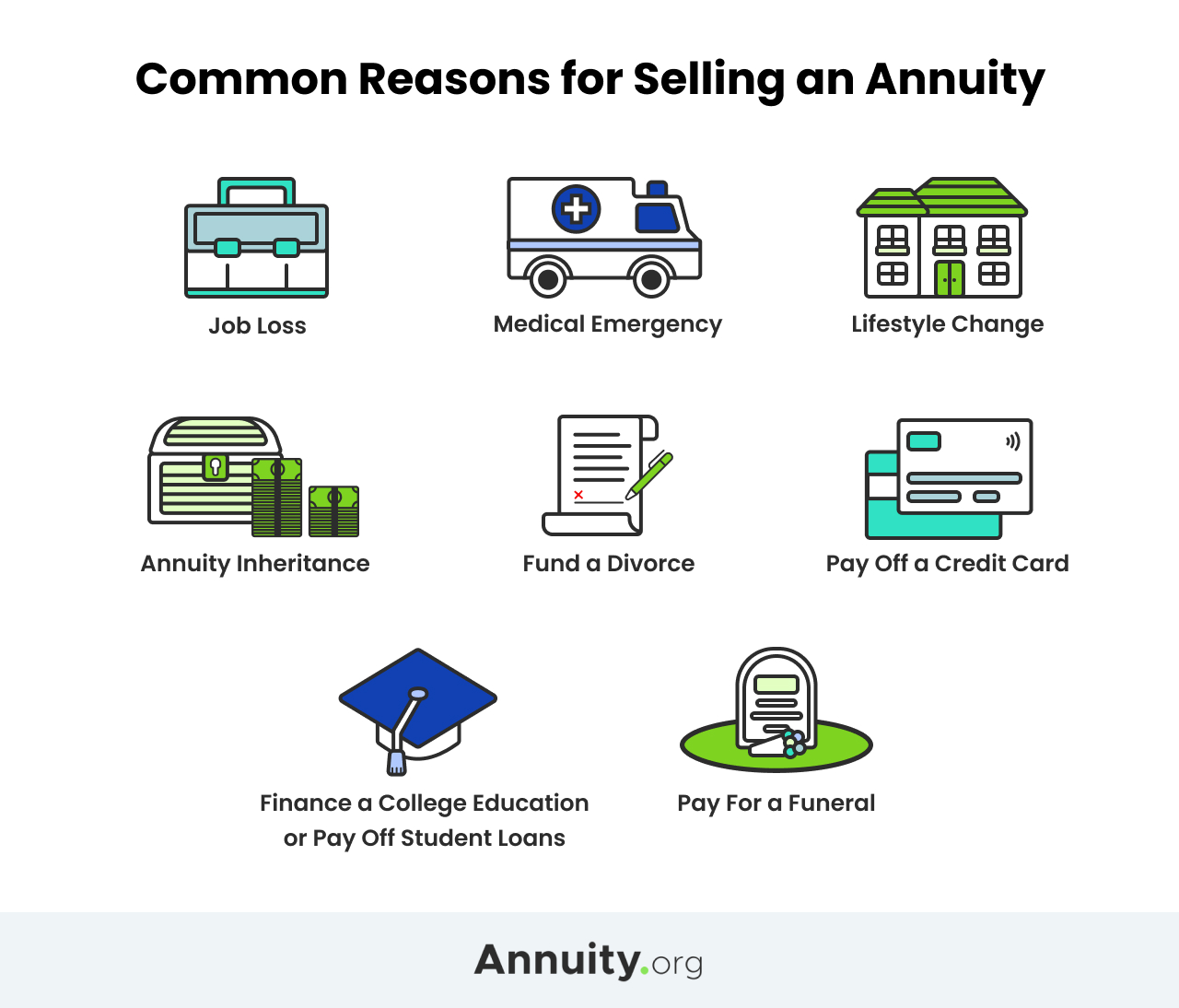

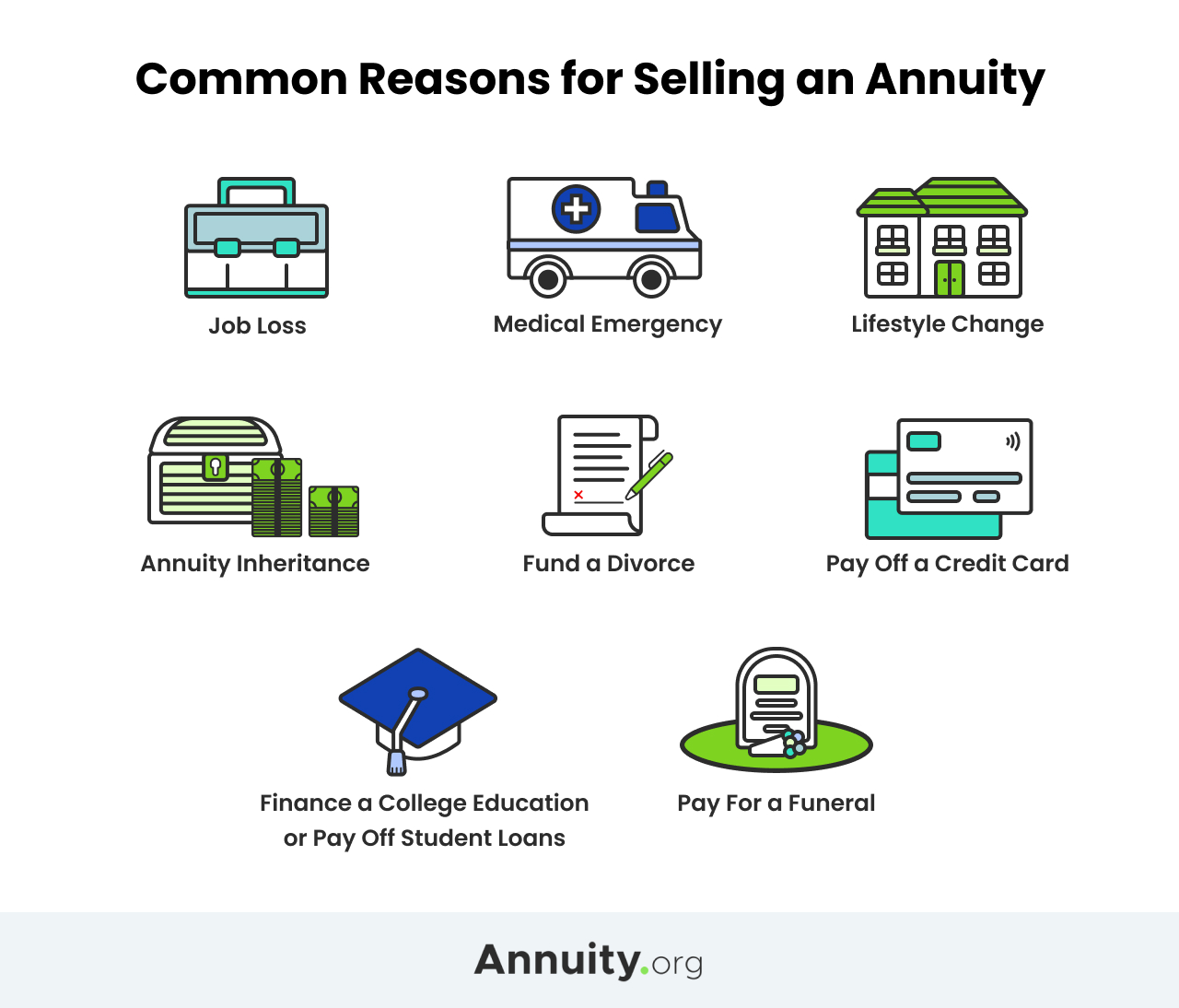

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

How Return Of Premium Life Insurance Works Nerdwallet

Depreciation Methods 4 Types Of Depreciation You Must Know

How Does Life Insurance Work The Process Overview

Life Insurance Quotes From 5 100 Gift Card Legal General

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)

/What-is-heteronormativity-5191883-FINAL-0c8f5100dbe04694a6fe1fbba052748f.png)

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)